Fresno County Property Appraiser

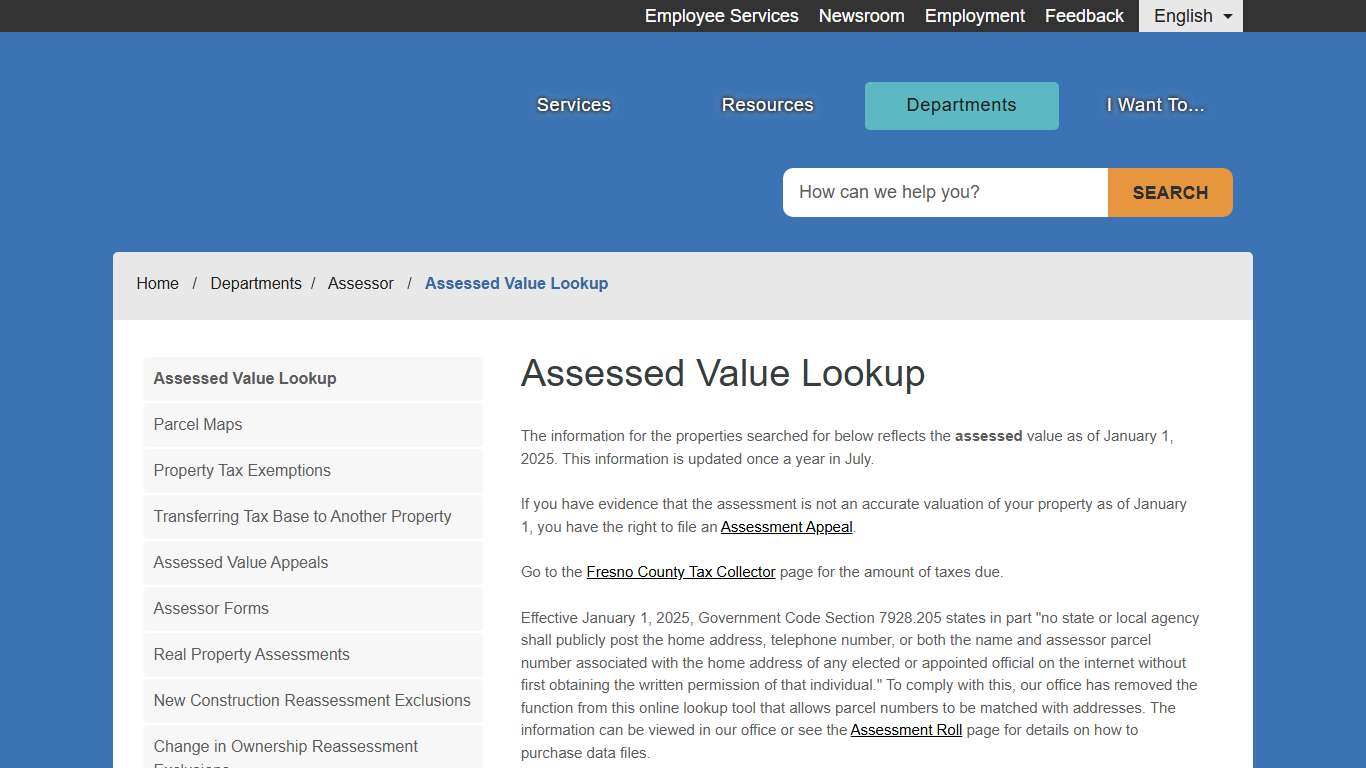

Assessed Value Lookup - County of Fresno

Assessed Value Lookup The information for the properties searched for below reflects the assessed value as of January 1, 2025. This information is updated once a year in July. If you have evidence that the assessment is not an accurate valuation of your property as of January 1, you have the right to file an Assessment Appeal.

https://www.fresnocountyca.gov/Departments/Assessor/Value

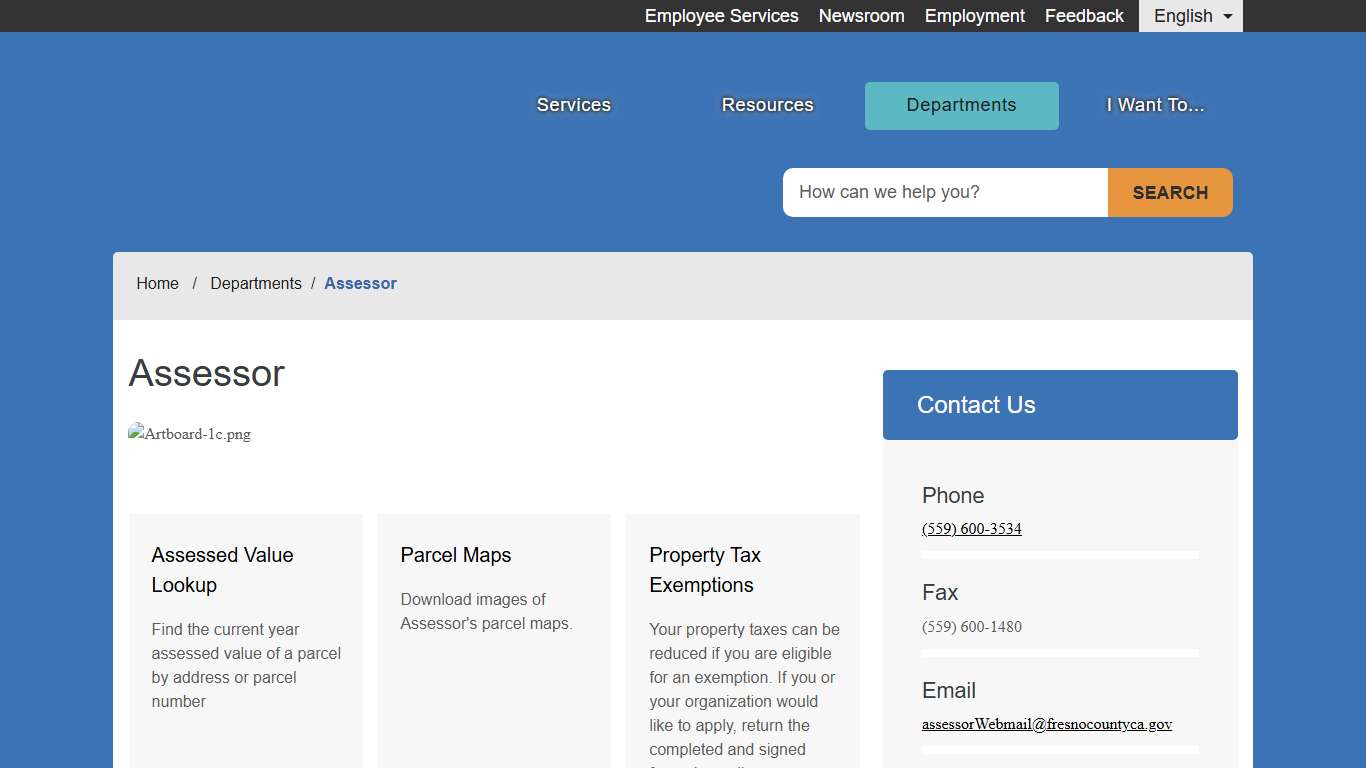

Assessor - County of Fresno

The Assessor's primary responsibility is to determine the appropriate taxable value of property each year, and to establish who is responsible for the taxes due.

https://www.fresnocountyca.gov/Departments/Assessor

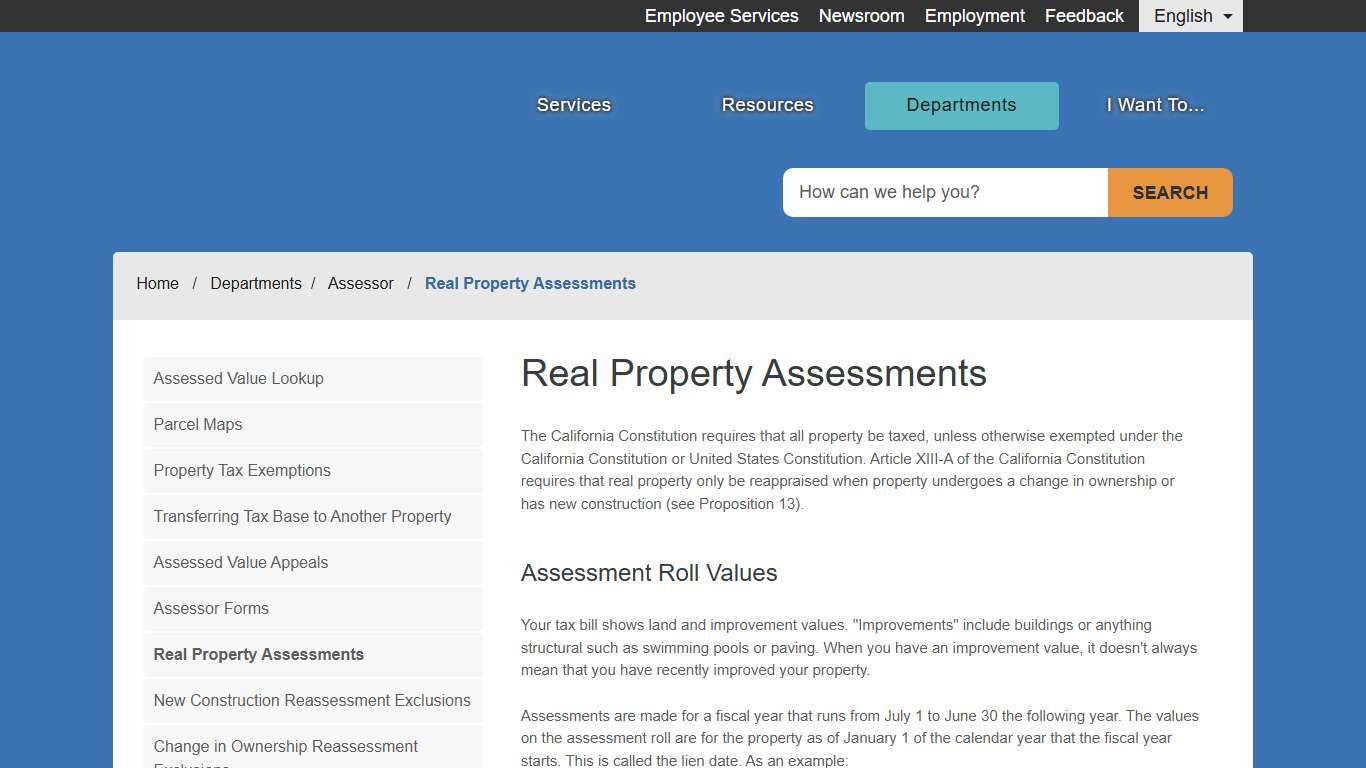

Real Property Assessments - County of Fresno

Real Property Assessments The California Constitution requires that all property be taxed, unless otherwise exempted under the California Constitution or United States Constitution. Article XIII-A of the California Constitution requires that real property only be reappraised when property undergoes a change in ownership or has new construction (see Proposition 13).

https://www.fresnocountyca.gov/Departments/Assessor/Real-Property

CAA e-Forms Service Center - fresno

Got questions about forms? Please visit our FAQ page or click on your county’s page for contact information. This site is updated at least annually. Forms for use in 2027 will be available starting January 1st, 2027. This is a California Counties and BOE website.

https://www.capropeforms.org/counties/fresno

Property Tax Information - County of Fresno

Oscar J. Garcia, CPA Auditor-Controller/Treasurer-Tax Collector Mario Cabrera Deputy Auditor-Controller Frank Gomez Deputy Treasurer-Tax Collector Phone Property Tax (559) 600-3482 Administration (559) 600-3496 Fax (559) 600-1444 Hours Of Operation Monday - Friday 8:00am to 5:00pm (excluding County Holidays) Saturday, April 5, 2025, from 8:00 am to 1:00 pm Location County of Fresno Hall of Records, Room 105 2281 Tulare Street Fresno, CA 93721 ...

https://www.fresnocountyca.gov/Departments/Auditor-Controller-Treasurer-Tax-Collector/Property-Tax-Information

Fresno Property Values Appraisers

Home Appraisals - Read before ordering your appraisal. Tips How is your property appraised?

https://fresnoappraisal.info/Fresno County’s property tax revenue has reached an all-time high. The Assessor’s Office reports that the total value of all taxable property is now more than $123 billion. Paul Dictos, the Fresno County Assessor-Recorder, says the tax roll represents the county’s economic growth. Out of the 15 cities that make up the county, Sanger saw the largest increase in assessed value compared to the previous year, at nearly 15%. KSEE24 News Facebook

Fresno County’s property tax revenue has reached an all-time high. The Assessor’s Office reports that the total value of all taxable property is now more than $123 billion. Paul Dictos, the Fresno County Assessor-Recorder, says the tax roll represents the county’s economic growth. Out of the 15 cities that make up the county, Sanger saw the largest increase in assessed value compared to the previous year, at nearly 15%.

https://www.facebook.com/KSEE24/videos/fresno-countys-property-tax-revenue-has-reached-an-all-time-highthe-assessors-of/1644003782941561/

Do You Know When Fresno County Property Taxes Are Due? Here Are the Deadlines - GV Wire

Fresno County Auditor-Controller and Treasurer-Tax Collector Oscar J. Garcia reminds residents that the first installment of the 2025-26 property tax bill is due Saturday, Nov. 1, 2025. Late payments are subject to penalties. However, there are multiple payment options available. (Shutterstock) Share Fresno County Auditor-Controller and Treasurer-Tax Collector Oscar J.

https://gvwire.com/2025/10/27/do-you-know-when-fresno-county-property-taxes-are-due-here-are-the-deadlines/

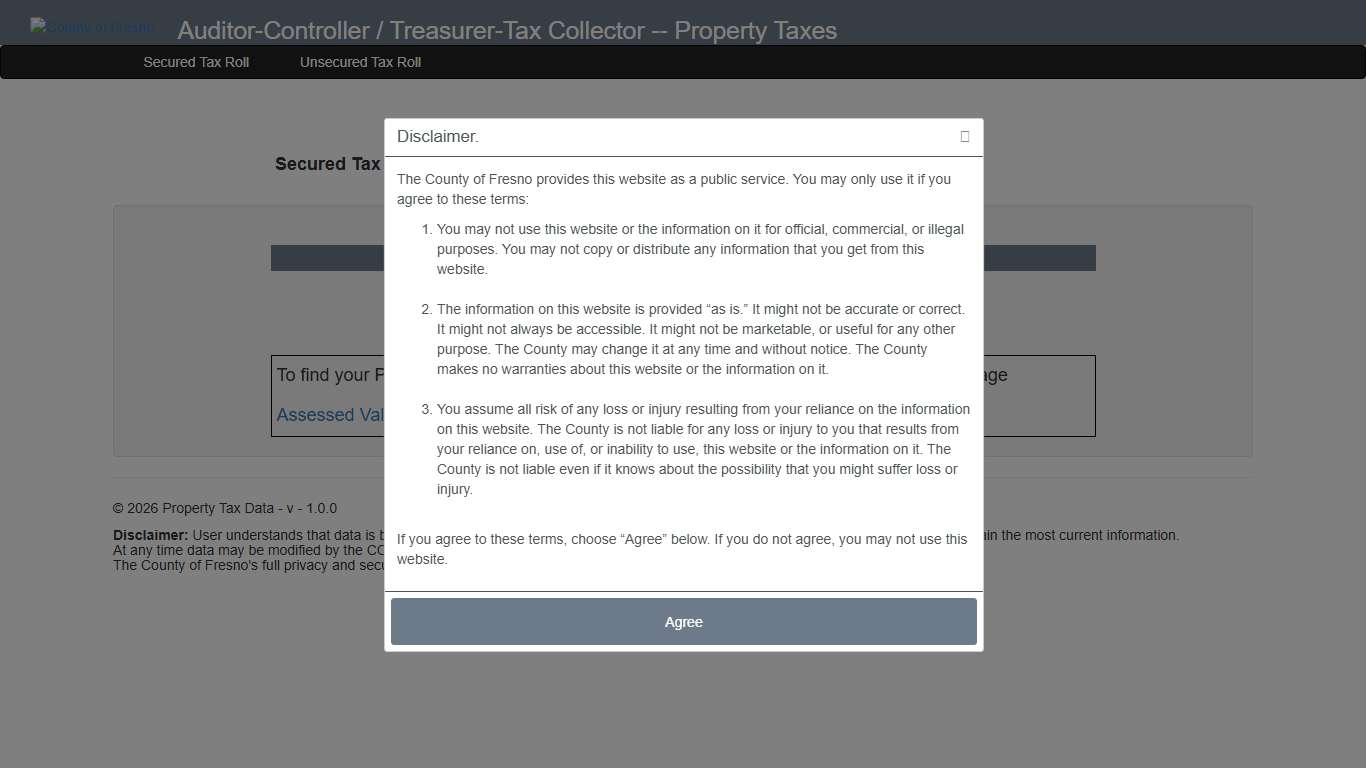

Home Page - My ASP.NET Application

Secured Tax Roll for Current (2025), Prior (2024), and Historical Records. Disclaimer. The County of Fresno provides this website as a public service. You may only use it if you agree to these terms: You may not use this website or the information on it for official, commercial, or illegal purposes.

https://fcacttcptr.fresnocountyca.gov/

Fresno Property Tax 101: Essential Tips for Homeowners - JVM Lending

Understanding the ins and outs of Fresno property tax is crucial for your property management and financial planning. In this guide, we cover the basics and nuances of property taxes in Fresno and provide you with helpful resources. What are Property Taxes?

https://www.jvmlending.com/blog/fresno-property-tax-101-essential-tips-for-homeowners/

Assessment Appeals Board

Sit as the Board of Equalization to hear appeals of property assessments for the County of Fresno ... 7/18/2023, 9/7/2026, District 4. Member, Hamilton, David P.

https://bosbcc.co.fresno.ca.us/Committees/CommitteeDetails/?committeeId=16

Fresno, CA Sales Tax 2026 Guide: Rates & Filing Tips Kintsugi

Navigating sales tax compliance in Fresno, California can be a challenge for businesses of all sizes. Understanding the local regulations, tax rates, and filing requirements is critical to staying compliant and avoiding penalties. At Kintsugi, we simplify sales tax compliance for businesses, helping you focus on growth without the headache of managing complex tax rules.

https://trykintsugi.com/sales-tax-guide/fresno-california-sales-tax-guide

Property Tax Information - County of Fresno

Oscar J. Garcia, CPA Auditor-Controller/Treasurer-Tax Collector Mario Cabrera Deputy Auditor-Controller Frank Gomez Deputy Treasurer-Tax Collector Phone Property Tax (559) 600-3482 Administration (559) 600-3496 Fax (559) 600-1444 Hours Of Operation Monday - Friday 8:00am to 5:00pm (excluding County Holidays) Saturday, April 5, 2025, from 8:00 am to 1:00 pm Location County of Fresno Hall of Records, Room 105 2281 Tulare Street Fresno, CA 93721 ...

https://www.fresnocountyca.gov/Departments/Auditor-Controller-Treasurer-Tax-Collector/Property-Tax-Information

BOE Tax Rate Area Maps – Fresno County 2025

Tax Rate Areas – Fresno County 2025 A tax rate area (TRA) is a geographic area within the jurisdiction of a unique combination of cities, schools, and revenue districts that utilize the regular city or county assessment roll, per Government Code 54900.

https://boe.ca.gov/maps/fresnoco.htm

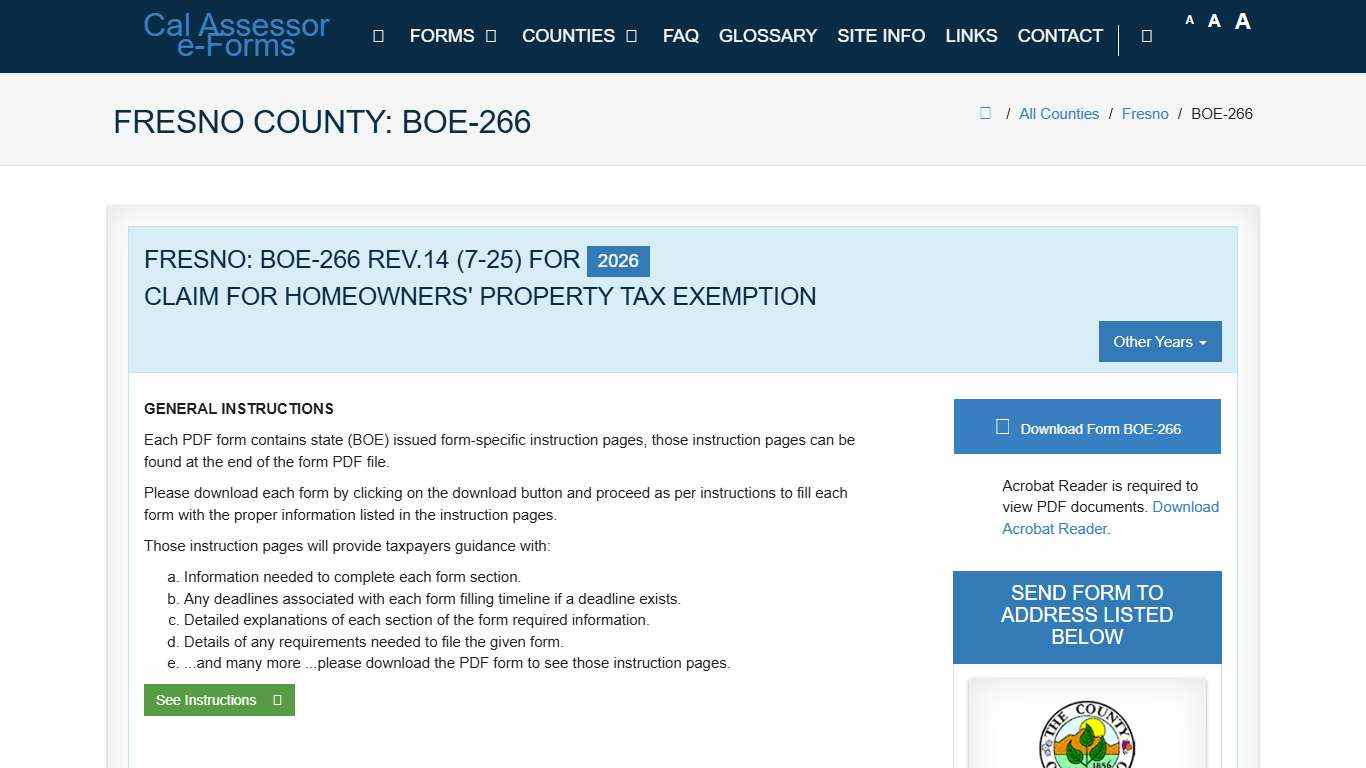

CAA e-Forms Service Center - Fresno: BOE-266

Got questions about forms? Please visit our FAQ page or click on your county’s page for contact information. This site is updated at least annually. Forms for use in 2027 will be available starting January 1st, 2027. This is a California Counties and BOE website.

https://www.capropeforms.org/counties/fresno/form/BOE-266/2026